March 8, 2015

Resist the urge

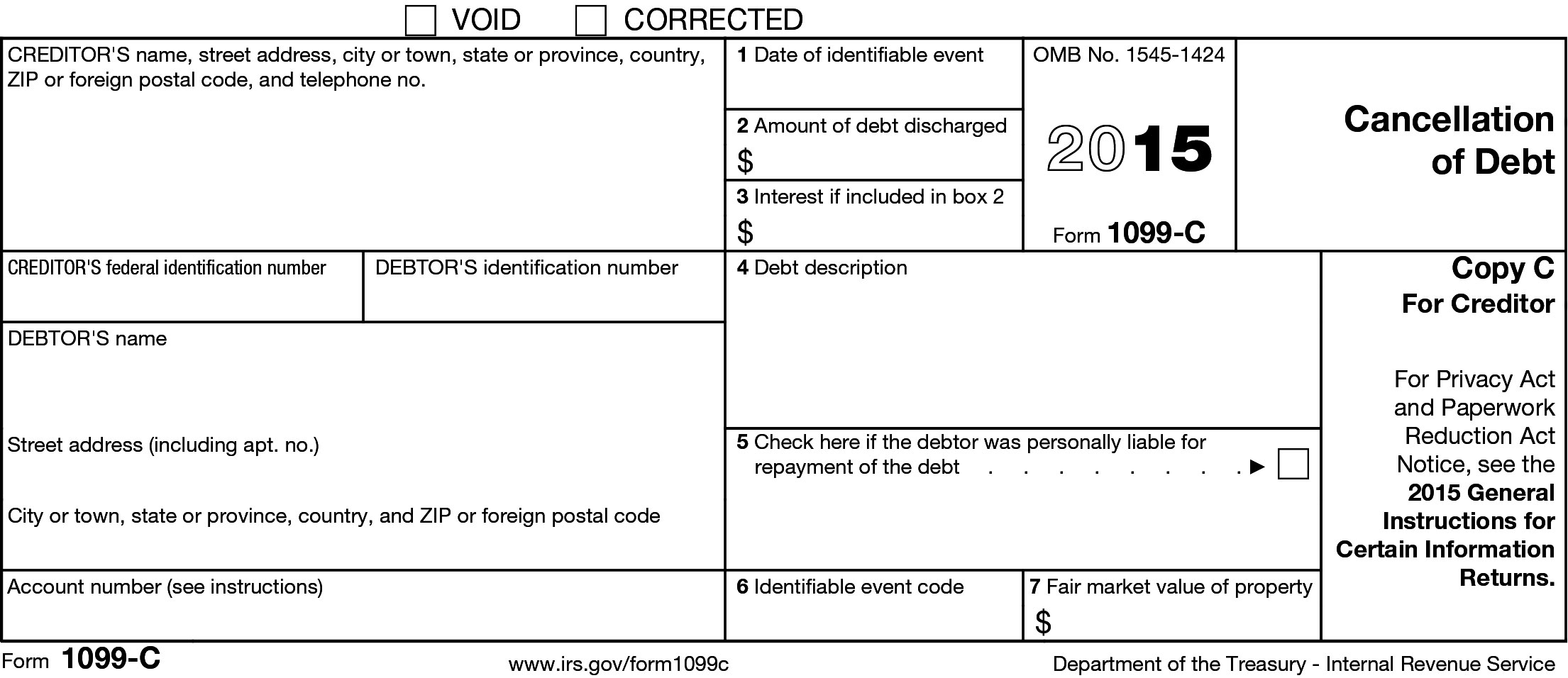

When clients don't pay, it's more than just annoying. You work hard, and they don't appreciate it. But don't be tempted to file a Form 1099-C and report the nonpayment as cancellation of debt.

The IRS Office of Professional Responsibility has stated that a tax professional who uses Forms 1099-C as a business strategy to collect unpaid fees calls into question the tax professional's fitness to practice before the IRS.1

Also, OPR says a pattern of issuing Form 1099-C with a reckless disregard as to the existence of a debt (because, for example, the former client does not have a fixed contractual liability to repay a sum previously received), or the absence of an "identifiable event" triggering a reporting requirement, is inconsistent with the standards of competency and professionalism embodied in the rules of practice.

If you can't collect the debt, we suggest you do no more work for the client (obviously), and if necessary, hire a really mean, cranky employee or a collection agency to collect it.

1 IRS Alert from Office of Professional Responsibility Issue 2015-02, "Practitioner's Use of Form 1099-C (Cancellation of Debt)"

Crazy alcohol and tobacco bills

If the California Legislature has its way, beauty salons will be able to serve alcoholic beverages without having an alcohol license. (AB 1322 Daly) Plus, there will be no chewing tobacco allowed at any baseball stadium, from high school through professional sports. (AB 768 (Thurmond)) We can't wait to see a state official march out to the mound at a World Series game and give a ticket to the tobacco-chewing pitcher!

Too bad the Legislature isn't concentrating on conformity!

Business e-file — must you?

California law requires a business to e-file its income tax return if the return is prepared with computer software. A taxpayer may request a waiver of the requirement online in cases where:

- The taxpayer has technology constraints;

- E-filing would result in undue financial burden; or

- In other circumstances that constitute reasonable cause and not willful neglect.

The law includes a penalty for failing to e-file for corporations, partnerships, LLCs, and exempt organizations. However, the penalty may not be applied until returns are filed for taxable years beginning on or after January 1, 2017.

The FTB has stated that, although no penalty would be applied, the law requires taxpayers to electronically file or request a waiver.

You can request a waiver online at:

www.ftb.ca.gov/professionals/busefile/Business_eFile_Waiver_Request.asp

The FTB has told us that, for this year, they will immediately grant a waiver to any taxpayer requesting one. One of the reasons they are requesting that you follow the waiver provisions is so they can collect information as to why taxpayers are requesting the waiver, so they can overcome potential obstacles in the future.

Northern California couple strikes gold — coins, that is

While on a daily walk, a couple spotted a rusted can sticking out of the ground near the base of a tree on their property. The couple dug it out and carried the extremely heavy can back to their house, where they discovered it was full of gold coins.

The coins range in date from 1847 to 1894, and many are in pristine condition.1 The "hoard," as grouped findings such as this one are called, is estimated to be worth $10 million and is speculated to be the most valuable buried treasure unearthed in the U.S.

The couple had previously noticed the tree under which the initial can was found because there was a similar rusted can hanging from one of the branches, and it was near an unusual rock formation. After finding the first can, the couple discovered that starting from the rock formation, the rest of the hoard was ten paces toward the North Star.2

Before contacting anyone regarding the possibilities of what they had found, the couple dug up the rest of the cans of coins ... and then reburied them for safekeeping until they were ready to come forward.

Found property is includable in gross income in the tax year in which the taxpayer has "undisputed possession."3 These taxpayers may have owned the property for some time, but the year of undisputed possession is clearly 2013 — when they found the coins, and the income is taxable in that year.

1 "California Family Discovers Buried Treasure," supra

2 "Hoard Interview" (February 25, 2014) Kagin's Inc. Available at: http://kagins.com/hoard-interview/

3 Treas. Regs. §1.61-14(a)

A few fun facts about this week's writers:

Lynn Freer, EA, loves to travel and loves Starbucks. Here she is at Starbucks on the Champs-Élysées.

Lynn Freer, EA, loves to travel and loves Starbucks. Here she is at Starbucks on the Champs-Élysées.

Kathryn Zdan, EA, is not only director of the editorial department, she also "rocks the house" as a regular in curling bonspiels around the country.

Kathryn Zdan, EA, is not only director of the editorial department, she also "rocks the house" as a regular in curling bonspiels around the country.

Never miss an issue

To get on the Tax Season Tribune mailing list, contact anthonya@spidell.com.