How do I love thee? With a 1099-MISC

By Kathryn Zdan, EA

Editorial Director

If hindsight is 20/20, then the foresight in this case was 20/200. (That's legally blind, by the way.) On paper, it seems obvious that the financial arrangement that landed a taxpayer in Tax Court was doomed to fail, but the heart (read: pocketbook) wants what the heart (read: pocketbook) wants.1

It's easy to get caught up in the juicy details of the case: A wealthy CEO was dating a much younger woman, whom he showered with gifts totaling $743,819 … none of which she included in income. But the case hinges on a $400,000 payment that was made to the girlfriend under a written agreement that the couple — who did not want to marry — would remain faithful to one another. You give me your undying devotion, I give you $400,000.

Not long after the agreement was made, the couple broke up; he accused her of having a relationship with another man, which he claimed voided the agreement. What does a CEO scorned do? He issued her a 1099-MISC for the full $743,819. A civil lawsuit ensued, and she eventually did pay back the $400,000, almost four years after she received it. In the meantime, the IRS still had her on the hook for tax on the full $743,819.

The taxpayer tried to get out of paying any tax at all, arguing that $343,819 were nontaxable gifts. She pointed to this being the outcome in the civil suit and claimed the IRS couldn't litigate the issue again under the doctrine of collateral estoppel. Regarding the $400,000 that she eventually repaid, she tried to invoke the doctrine of rescission for amounts repaid that were — here's the distinction — originally included in income.

She lost on both fronts. The court decided that collateral estoppel didn't apply in this situation because the IRS was not party to the civil suit. And as for the doctrine of rescission (which acts as an exception to claim of right), she hadn't included the $400,000 in income to begin with, and hence had not paid tax on it, so there was nothing to rectify.

1 Blagaich v. Comm., TCM 2016-2

The year is 1915 — 101 years ago

By Lynn Freer, EA

Publisher

Here are some statistics for the year 1915:

- Only 8% of the homes had a telephone

- The average U.S. worker made between $200 and $400 per year

- A competent accountant could expect to earn $2,000 per year

- Crossword puzzles, canned beer, and iced tea hadn't been invented yet.

- Marijuana, heroin, and morphine were all available over the counter at local corner drugstores. Pharmacists claimed, "Heroin clears the complexion, gives buoyancy to the mind, regulates the stomach, bowels, and is, in fact, a perfect guardian of health!" (Shocking?)

- The five leading causes of death for a tax professional were: (editorial comments added)

- Pneumonia and influenza — getting germs from sneezing, coughing clients

- Tuberculosis — maybe caused by fumes from green eyeshades

- Diarrhea — not eating at regular hours

- Heart disease — client has four oil and gas K-1s, a delayed exchange, and wants the return tomorrow

- Stroke — stress from clients complaining about the fee because "all you do is put the numbers in the computer"

Today, you can forward the Tribune to someone else without retyping it. From there, it will be sent to others all over the WORLD, all in a matter of seconds! It is impossible to imagine what it may be like in another 101 years.

Tax Time

By Lynn Freer, EA

Publisher

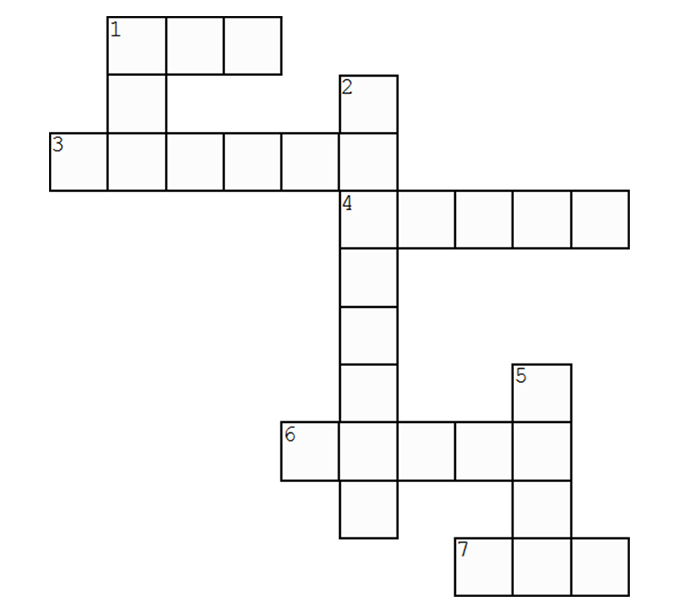

Complete the crossword below.

Across

- Try to avoid this tax

- Unmarried

- Month filing season ends

- Type of foreign reporting

- Are you tired?

Down

- Last number on p1 of 1040

- Client who doesn't pay

- Opposite of working early is working ____

POA from the future gets rejected

By Kathryn Zdan, EA

Editorial Director

With all the recent changes to MyFTB and how POAs are submitted, we thought we had seen it all. One of our subscribers told us this story about his dealings with a client who lives in Thailand:

I requested a POA and tried to use it immediately. Funny thing is that he is on the other side of the International Date Line, so it was signed and dated one day ahead. I tried to use the POA, and was rejected. I used it the next day with no issues … same POA, same date, same everything.

The difference: It was signed tomorrow, not today in California!

A few fun facts about this week's writers:

Lynn Freer, EA, loves to travel and loves Starbucks. Here she is at Starbucks on the Champs-Élysées.

Lynn Freer, EA, loves to travel and loves Starbucks. Here she is at Starbucks on the Champs-Élysées.

Kathryn Zdan, EA, is not only director of the editorial department, she also "rocks the house" as a regular in curling bonspiels around the country.

Kathryn Zdan, EA, is not only director of the editorial department, she also "rocks the house" as a regular in curling bonspiels around the country.

Never miss an issue

Did a friend forward this to you? To get on the Tax Season Tribune mailing list, contact anthonya@spidell.com.

Answer key:

Across: 1. AMT, 3. Single, 4. April, 6. FATCA, 7. yes; Down: 1. AGI, 2. Deadbeat, 5. Late 1. AMT, 3. Single, 4. April, 6. FATCA, 7. yes; 1. AGI, 2.Deadbeat, 5.Late