Rob Lowe wins big in California tax appeal

By Renée Rodda, J.D.

Vice President

The Board of Equalization recently allowed actor Rob Lowe and his wife, Sheryl Berkoff, to include millions of dollars of improvement costs in the basis of their home, even though the Lowes conceded they had no records to substantiate the costs.1

The Lowes sold their home in Montecito, California in 2005 for $25,000,000, and reported a gain of just over $10 million. However, the FTB examined the Lowes' 2005 return and determined that they had underreported their gain by approximately $9 million. The taxpayers are obviously not in dire financial straits here, but that sort of gap results in a large tax assessment by anyone's standards.

The Lowes argued that they were unable to present documents to support their basis numbers because their business manager had lost them (apparently his computer had crashed). They did, however, present testimony from their business managers, as well as contractors and professionals who had worked on the property.

The Lowes asked the Board to apply the Cohan rule, and allow an estimate of their construction and improvement costs. Continuing what has been a taxpayer-friendly trend in recent Board decisions, the Board ruled in favor of the taxpayers and allowed them to adopt a basis of $12,167,208, which results in an estimated tax benefit to the Lowes of $514,000.

There was some disagreement among the Board members on this case. The five-member Board voted 3-2 in favor of the taxpayers, but Board Member Jerome Horton then issued a press release stating, "The gap between the rich and poor just got wider with this gift of public funds to one of our most affluent citizens. I love Rob Lowe's movies, but not enough to gift him $514,000 of California's taxpayer dollars."

To view the recording of the November 17, 2015 Board meeting where this case was heard (and the Lowes testified), go to www.youtube.com/watch?v=UHI3GghAPYo. The case is heard about 38 minutes in.

1 Appeal of Lowe and Berkoff, Cal. St. Board of Equal. Case No. 571973

Stop in the name of malpractice

By Tim Hilger, CPA

Senior Editor

"Good morning, Santa Rosa … er … San Rafael. Where am I?" After more than two months on the road for our Fed/Cal seminars I had a bad case of RRS (Repeatedly Redundant Syndrome). Every hotel begins to seem the same, the rental cars are all boring, and the questions I get from attendees are redundantly repeated.

Without a doubt, the most common question I got from attendees this season was some variation on this: "My client has seven employees, one of which is the owner. The company reimburses the owner for his health insurance that covers his entire family. One employee is on Medicare, and the company reimburses him for his Medicare premiums. The company provides health insurance for two employees but doesn't cover the other three. Is that okay?"

By the end of the season my pat response was: "STOP!"

Notice 2013-54 has made tax practitioners as nervous as a long-tail cat in a room full of rocking chairs. It provides for a penalty of $100 per day per participant in nonqualifying health reimbursement arrangements, which can include such common arrangements as HRAs and health FSAs. With only three participants, that reckons to over $100,000 per year.

Look, I understand. Our clients want us to be their lawyer, their investment advisor, and their marriage counselor — and if one won't, another one will. And with almost a million tax practitioners in the U.S., there's always another one just down the street.

But, let me ask you this: As a tax practitioner, do you advise your clients on the intricacies of operating their pension plans? Of course not and for obvious reasons — because operating a pension plan involves more than tax law, most notably complying with ERISA. We tell our clients to go visit a pension consultant.

Well, guess what? Health insurance and reimbursement arrangements for employees are now covered not only by the Internal Revenue Code but also by ERISA, HIPAA, the ACA itself, and other laws.

Just accept it. When it comes to tax practitioners advising clients on health plans for employers, we're now as competent as a one-legged man in a butt-kickin' contest and as useful as a steering wheel on a mule. So, STOP!

Tell your client to go see a benefits consultant and if they won't, let them go to Another One down the street. When it's Another One's malpractice suit and not yours, you'll be grinnin' like a goat in a briar patch.

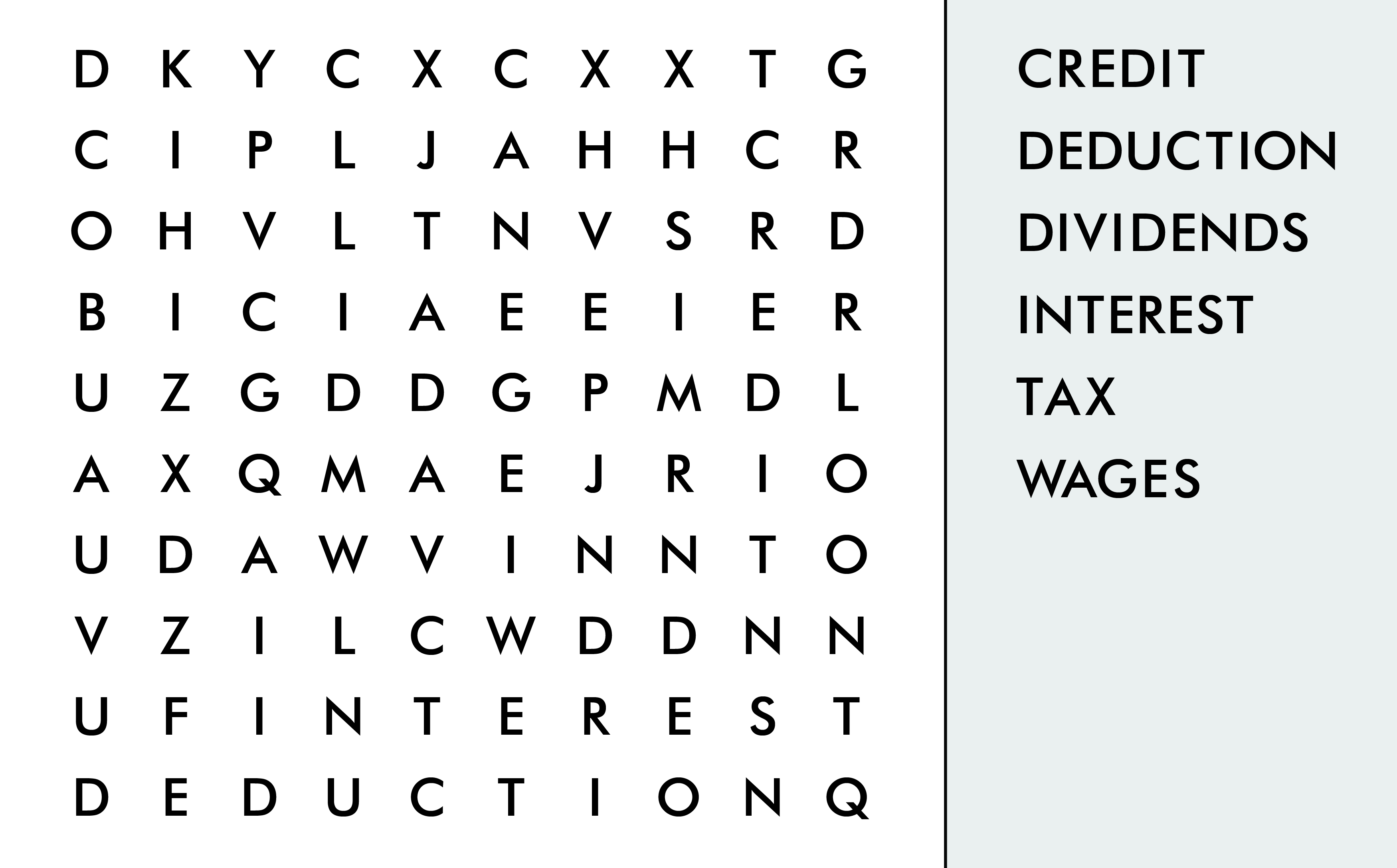

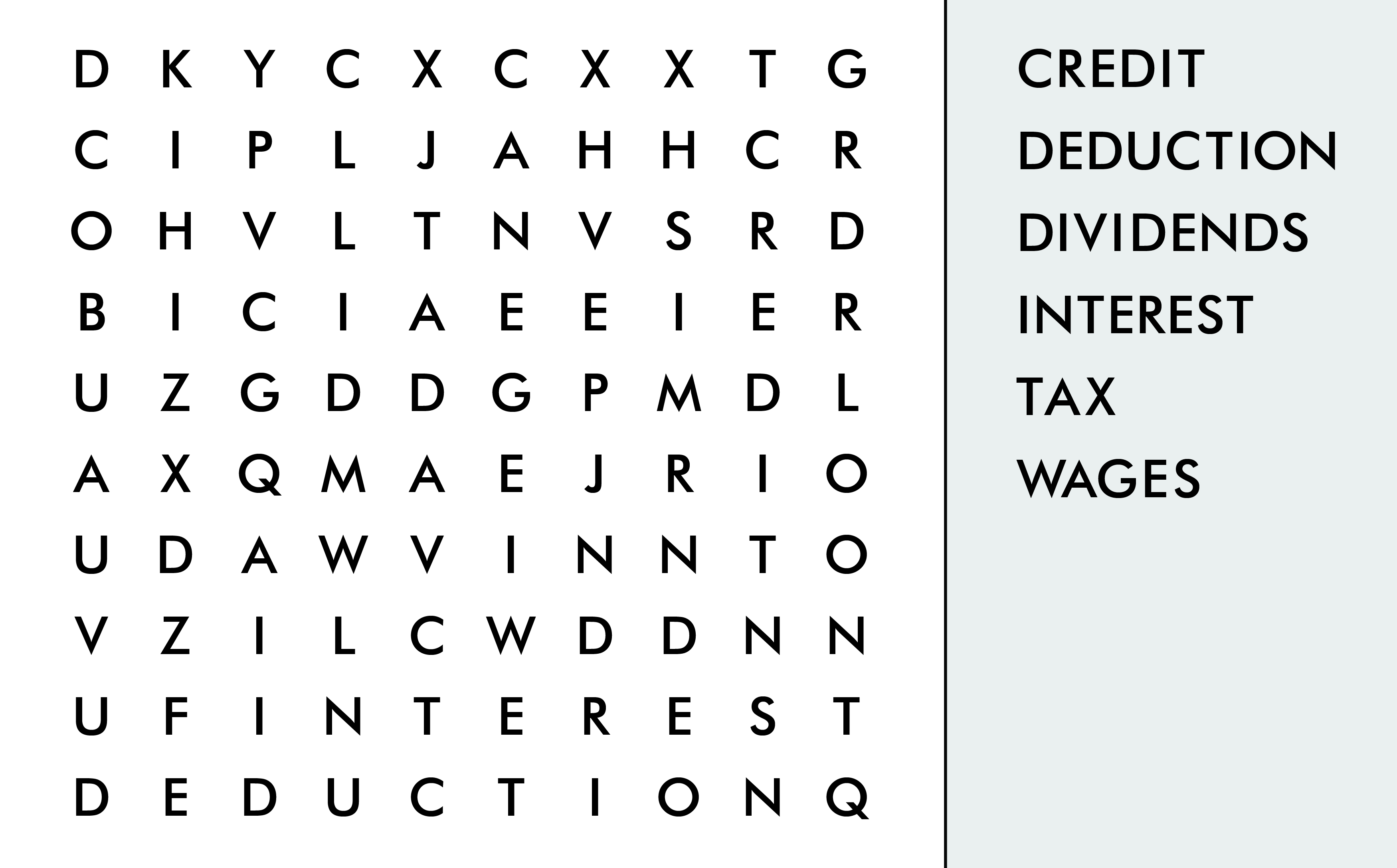

Tax Search

By Renée Rodda, J.D.

Vice President

If you're tired of crunching numbers, try crunching letters! Click here for the answers.

A few fun facts about this week's writers:

Renée Rodda, J.D., when not writing, researching, and helping Spidell customers, enjoys riding her horses, Eli and Ava.

Renée Rodda, J.D., when not writing, researching, and helping Spidell customers, enjoys riding her horses, Eli and Ava.

Tim Hilger, CPA, is busily preparing taxes today. Tim is a golf nut who has played courses in all 50 states and often reminisces about his younger days shredding on his bass guitar.

Tim Hilger, CPA, is busily preparing taxes today. Tim is a golf nut who has played courses in all 50 states and often reminisces about his younger days shredding on his bass guitar.

Never miss an issue

Did a friend forward this to you? To get on the Tax Season Tribune mailing list, contact anthonya@spidell.com.