Today is Selection Sunday, the day the NCAA announces which schools will be competing in this year’s March Madness championship tournaments for men’s and women’s college basketball. That makes tomorrow a Selection Monday of sorts, where millions of sports fans across the country begin to select which pools run by co-workers, friends, and family they will participate in this year. (And the day after that, lest a marketing opportunity go to waste, mini basketballs return to Pizza Hut for the first time in more than 20 years!)

March Madness is no doubt one of the most popular occasions for sports betting, even though the odds of picking a perfect bracket — something the NCAA says has never happened, by the way — are 1 in 9.2 quintillion. A 2021 estimate from the American Gaming Association said that 47 million Americans were expected to bet on that year’s tournament.1

But figures for other recent sporting events are also impressive: 20 million Americans planned to wager $1.8 billion on the 2022 FIFA World Cup,2 and for Super Bowl LVII last month, 50 million Americans were expected to bet $16 billion.3

So much money is on the line that the biggest winners are actually the states that have legalized sports betting following a 2018 Supreme Court ruling. In 2022, New York, Pennsylvania, and Illinois each brought in more than $100 million, contributing to a nationwide total of more than $1.5 billion in sports betting revenue.4

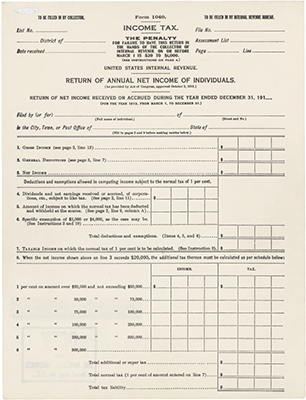

And if you forgot to tell your clients they need to report last year’s gambling winnings, don’t fret. Now that the filing deadline for most Californians and some taxpayers in Georgia and Alabama is October 16, you still have plenty of time before the final buzzer.