Post your help wanted or job wanted ad here, and let the community help.

Welcome to Spidell’s Job Posting Board, where we connect opportunity with availability! Whether you are an employer with a position to fill or are searching for your dream job, this free service is available to help you navigate the job market. Just follow these few simple steps to post your information on the board: Click the submission links below and enter your name, city, and contact information. If you’re an employer, provide an accurate job description (limited to 600 characters); and if you’re a job seeker, highlight your experience and specific skills (600 characters or less, please). Your posting will stay active for 30 days and can be renewed at your request.

Help Wanted

Looking for the opportunity to put your skills to good use, or longing for a short commute? Check here for job openings, and revisit this page often for new postings. Employers, click here to submit your posting

Position: Tax/Staff Accountant

City: Redlands, CA

Growing Redlands/Inland Empire CPA firm providing high quality tax services has Tax/Staff Accountant opportunity available.

Required skills and qualifications:

- Preparation/review of individual, business and fiduciary tax returns

- Five years of tax preparation, planning, review and research experience/technical skills

- Experience working in a CPA firm

- Proficiency with QuickBooks, Microsoft Office and CCH Axcess Tax software

- Demonstrates skills necessary to ensure high quality client services

- Compensation will be commensurate with experience. Please include compensation requirements

Contact: barbara@jcmapac.cpa

Position: Tax Preparer City: Oxnard/Port Hueneme area in Ventura Counry

I am looking for a licensed, experienced tax preparer for the upcoming tax season. My office is year round and we do about 700 returns. I will need a full time and part time preparer for a busy office.

I will be open to discuss terms and hours. Please give me a call, would love to meet with you.

Nancy Olivares, EA

721-A W. Channel Islands Blvd

Port Hueneme, CA 93041

805-985-1225 Responsibilities: Required skills and qualifications: License/Certification: Contact: Nancy Olivares EAat93041@aol.com.

Position: 2023 Tax Season Checker City: El Segundo, CA

Tristar is searching for a detail-oriented tax preparer to assist with tax planning and joining one of the best hard working tax firms in the Southbay area. Responsibilities: Review various financial documents in order to prepare tax returns and provide tax services

Develop and execute tax strategies after researching potential deductions and liabilities Required skills and qualifications: Two or more years of experience in public accounting and/or tax planning and preparation

Exceptional analytical and problem-solving skills License/Certification: CTEC (Required) Contact: Please e-mail your résumé to Dee Byars at reception@tristaretg.com.

Position: Bookkeeper, Accountant City: Antioch, CA

Bookkeeper/Accountant needed to input & prepare bookkeeping for local CPA’s business clients. We offer 401(k), vacation, holidays, health insurance. Position requires 25 to 40 hours per week, depending on work load. Pay is $25 per hour. Send resume & references via email. Contact: Please e-mail your résumé to Earline La Buy at elabuy.cpa@prodigy.net.

Position: Tax Preparer – CPA /EA preferred City: Irvine, CA

Tax Professional – CPA or EA preferred.

Strong technical skills with individuals and businesses.

Prepare and review tax returns (Individuals, S-Corps, C-Corps, Partnerships, Trusts). Prepare individual (1040) federal and state tax returns.

Must be able to prepare personal returns with Schedule A, B, C, D, E, and SALT work around plus other various schedules as required. Prepare tax returns for businesses and estates (1120, 1120S, 1065, 1041).

Experience with Drake Software is helpful.

Gig, Part/full-time position available.

Flexible/full schedule. Contact: Please e-mail your résumé to Randy Pierce at randy@piercegroup.us.

Position: Tax Manager City: Alameda, CA

As a Tax Manager, will be seen as a trusted partner of the Company’s tax function. You will partner with other business departments including but not limited to accounting, finance, and Company’s external tax advisors. You will primarily oversee/participate in the Company’s income tax function but are flexible to help in other areas of the Company’s tax function as needed. We are looking for 5-7 years of experience in partnership and flow through tax in public accounting and/or U.S. private equity owned national company. You will spend up to 3 days per week at our Alameda, CA Home Office. Contact: Please e-mail your résumé to Steven at steven.ngim@worldmarket.com.

Bianchi, Kasavan & Pope, LLP is a full-service CPA firm with office locations throughout the Central Coast of California (Hollister, Monterey, and Salinas). We are seeking tax professionals for all locations.

Requirements: 7+ years of high-level experience in preparing and reviewing individual, fiduciary, partnership, and corporate tax returns for high-net worth clients. Experienced using Lacerte and ProSystem Tax software is preferred.

We offer a competitive compensation and benefit package. Contact: Please e-mail your cover letter, résumé, and salary history to June Barnes at juneb@bkpcpa.com.

Experienced Full-Time Tax Professional

CPA or EA preferred.

5 + years of experience – individuals and businesses.

Prepare and review tax returns (Individuals, S-Corps, C-Corps, Partnerships, Trusts). Prepare individual (1040) federal and state tax returns.

Must be able to prepare personal returns with Schedule A, B, C, D, E, and F and other various schedules. Prepare tax returns for businesses and estates (1120, the 1120S, 1065, 1041).

Must be able to prepare Corporate, S-Corp, Partnership, and Estate tax returns. Experience with Lacerte Tax Software is preferred. Contact: Please e-mail your résumé to Brad Plaschke at brad@smithcpas.com.

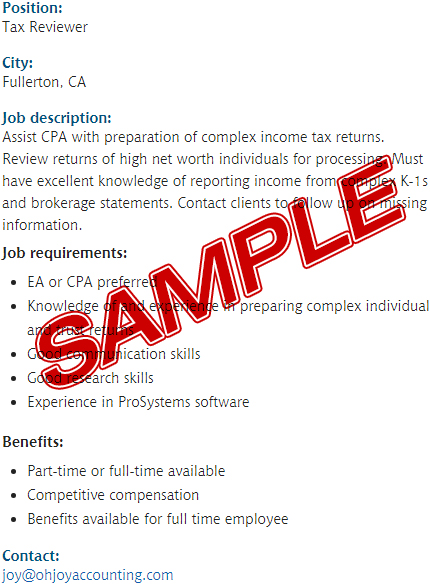

Moon & Mandella Accountancy Corporation is seeking a tax preparer for individual, fiduciary, partnership/LLC, & corporate returns for high net worth individuals and closely held businesses.

CPA/EA preferred, or candidate with a minimum 3 years tax preparation experience, and working knowledge of ProSystem fx Tax software.

Part-time or full-time positions available, with competitive compensation and benefits for full-time employee.

Comfortable work environment with flexible schedule.

Direct hires only inquire, please no agencies. Contact: Please e-mail your résumé to Roger Stroud at rstroud@moon-mandella.com.

Do you love tax but hate the idea of working 40+ hours year round? You’re in luck! We are looking for experienced tax preparers for the 2022 tax season. The ideal candidate is willing to work 30-40 hours during tax season to assist our full-time staff with tax preparation.

Who are we? EP Wealth Advisors Admin, LLC (“EPWA”) is a wealth management advisory firm with over $15 Billion in AUM as of December 31, 2021, serving predominately high net worth individuals.

EP is looking for remote Tax Preparers in the following states AZ, CA, CO, WA, TX, MA, PA, UT, IL, GA,SC and WA. Contact: Please e-mail your résumé to Erin Voisin at evoisin@epwealth.com.

We prepare over 2,500 tax returns and are hiring experienced tax professionals. We offer various commission structures. You can work your own schedule. Our returns range from the simplest of tax returns to partnerships, trusts, S-corps, C-corps, LLC, etc…

We are a small family oriented office and have been open for over 50 years.

We use Lacerte. Contact: Please e-mail your résumé to Damon Simpson at info@protaxservices.com.

- Prepare and review tax returns for accuracy

- Able to prepare individual, business, and trust tax returns

- Primarily 1120S, 1065, and 1041 returns

- Able to prepare concise open item lists

- QuickBooks experience and knowledge

- Experience with CCH Access Tax preferred

Contact: Please e-mail your résumé to Lisa Wofford at admin@fullertonbusinessservice.com.

THIS IS A FULL-TIME SEASONAL POSITION (DEC 12 , 2022 TO APR 21, 2023)

This office is open 9am to 5pm Mon-Fri and closed Sat & Sun

Starting January 2nd, 2023 we will be open from 9am-7pm Monday through Friday, 9 am to 5 pm Sat and closed on Sun.

No remote work Requirements:

- Minimum of THREE to FIVE years tax experience

- Drake software, TaxSlayer Software, and QuickBooks/QB Online experience a plus

- Ability to work independently and work on a return from start to finish

- Ability to handle multiple returns throughout the season

- Tax Preparation Certification and bond required

Contact: Please e-mail your résumé to Gem Redondo at info@ibi.llc.

THIS IS A FULL-TIME SEASONAL POSITION (JAN 30, 2023 TO APR 21, 2023)

The office is open 8 am to 6 pm Monday through Thursday, 8 am to 4:30 pm Friday and 9

am to 2 pm Saturday

Hours are flexible

No remote work

Minimum of FIVE years tax experience working as a tax preparer in a

Business Management firm REQUIRED

Tax Preparation Certification, Enrolled Agent or CPA license and bond required

Preparation of Individual tax returns

Corporate, Partnership, LLC, and Trust return experience a plus

Accounting experience a plus Contact: Please e-mail your résumé to Kathi Blanton at taxcntroc@aol.com.

- Minimum of THREE to FIVE years tax experience

- ProSystem Fx, Datafaction, and QuickBooks/QB Online experience a plus

- Ability to work independently and work on a return from start to finish

- Ability to handle multiple returns throughout the season

- Tax Preparation Certification, Enrolled Agent or CPA license required

Responsibilities:

- Preparation of Corporate, Partnership, LLC, Trust, and Individual tax returns

- Preparation of year-end projections

- Review of financial statements for accuracy

- Assist with tax notices, tax payments, state tax filings, etc

Contact: Please e-mail your résumé to Lety Guzman at lety.guzman@pfmi.com.

Tax techs work at our call center assisting taxpayers with general tax information and possibly collections — all training is provided. Minimum Requirements: See Online Tax Technician Exam for full details. Applying for the State Of California — Franchise Tax Board:

- Login/Register for Calcareers

- Take the Online Tax Technician Exam

- Apply by 9/1/22

Job Links: Permanent Intermittent (English) and Bi-Lingual Spanish Permanent Full Time (English) and Bi-Lingual Spanish Contact: Feel free to e-mail me if you have any questions about applying with the State of California.

Flexible Hours Available! Contact: Please e-mail your résumé to Janelle King at janelle.king@jtax.com.

- An experienced tax preparer with up-to-date Enrolled Agent certification

- 3+ years of experience filing taxes for small businesses and individuals

- Familiar with the following software: QuickBooks Online, Excel, Google Sheets, Basecamp, Zoom, Slack, Google Drive

- A home office or quiet space to work with clients

Contact: Please e-mail your résumé to Leah Moyer at leahmoyer47@gmail.com.

- Preparation of individual and business, federal and multi-state tax returns — Drake Software

- Perform Quickbooks bookkeeping, prepare and enter year-end adjusting entries QUICKBOOKS

Tax Preparer Requirements and Qualifications Proven work experience as a CPA or EA ***** REQUIRED ***** Contact: Please e-mail your résumé to Tax Hardship Center — Vache Amirkhanyan at vache@taxhardshipcenter.com.

We are located in the heart of Marin County with easy access to San Francisco and the East Bay. Our firm was founded in the 1950’s and nearly all of our employees have been with the firm for many years.

The ideal candidate would have one to five years of broad-based tax and accounting experience with a public accounting firm. Contact: Please e-mail your résumé to Jeff Wilcox at jwilcox@jslllp.com.

- CPA

- Experience at a Big 4 accounting firm

- Master’s Degree in Accounting

- 8+ years of accounting experience in an investment, banking, venture, or finance organization

- Strong knowledge of US GAAP accounting, internal controls, and public company financial reporting

- Proficient in financial modeling and private company valuation

- Understanding of venture capital

Contact: Please e-mail your résumés to CFO@surocap.com with your name in the subject line.

Candidates with PTIN and CTEC License are preferred.

- Help take them over

- Purchase the clients

- Become a referral source so we can refer them out.

These are mostly individual clients, with relatively basic tax filings which may include Sch A-E. Depending on your capacity, it can be as little as 100 clients up to about 250 clients.

Please contact me by email if you are interested. Contact: Please contact Troy Yoshida at troy@troycpa.com.

Pay: $50.00 – $75.00 per hour

Please note that we are only accepting in-office candidates at this time. Thank you for your understanding.

Website: https://www.jacksondownstsurudacpa.com/ Contact: Please e-mail your résumé to Alex Tsuruda at alex@jdtcpa.com.

We are located in the heart of Marin County with easy access to San Francisco and the East Bay. Our firm was founded in the 1950’s and nearly all of our employees have been with the firm for many years.

The ideal candidate would have one to five years of broad based tax and accounting experience with a public accounting firm.

More information can be found on our website www.jslllp.com. Contact: Please e-mail your résumé to Jeff Wilcox at jwilcox@jslllp.com.

- Bachelor’s degree in accounting, business or finance

- Current CPA or EA license preferred

- Minimum of 10 years of tax experience

- Proficiency with Microsoft Office and QuickBooks as well as tax software (proficiency in Lacerte)

- Knowledge of K-1’s and 1040’s is a must

- Great communication skills

Contact: Please e-mail your résumé to Danielle Pelzner, HR Director, Pelzner & Associates, at danielle@pelznerassociates.com.

- Prepare and review federal and state tax returns for high net worth individuals and trusts

- Participate in internal strategy discussions for clients, collaborate with advisor teams and planning departments to address tax services objectives.

- Manage coordination and integration of tax services, analysis, and department projects.

- Prepare tax projections and other tools for use in wealth planning engagements.

- Responds to tax notices of any sort

- Other duties as assigned

Contact: Please e-mail your résumé to Therese Tippie at ttippie@epwealth.com.

Degree with acct emphasis preferred; relevant CPA firm experience helpful; extensive QB knowledge, ProAdvisor certificate a plus; addtn’l software proficiency a plus; firm uses TR Ultra Tax/File Cabinet, Excel, Word, Outlook, QB. Good org, verbal and written comm skills; ability to do self-review. PT 32 hrs/wk; benefits Contact: Please e-mail your résumé to Mary Colby at mcolby@ckgcpas.com.

- Enrolled Agent with a current license.

- Must have at least 5 years’ experience in tax preparation.

- Prepare personal tax returns from beginning interviews through completion of final signing.

- Corporate, Partnership, Trust and Estate Returns a plus.

- Assist in correspondence with taxing agencies.

- Off season tax planning, W4 changes, Estimates, Stock option planning and taxation.

- Proficient in Microsoft Outlook, Excel, Word and LACERTE tax software.

- Strong attention to detail, deadline-oriented, time management.

- Must be proficient in English both verbally and written.

- Office open Tuesday, Wednesday & Thursdays during the off season.

- Continued Professional Education offered through designated providers.

Contact: Please e-mail your résumé to Jean Southward at jean@southwardtax.com.

- Preparation of federal and state income tax returns for individuals, including corporations (C and S), limited liability companies, partnerships, trusts, estates, and foundations.

- Complex tax research in response to client tax matters and preparation of research memos.

- Management of multiple clients.

- Licensed CPA and/or Enrolled Agent required

Contact: Please contact Shira Nachshon or Preston Sadikoff. Résumés can be e-mailed to shira@bmgmt.net.

- Desire to become a tax partner in the Not-For-Profit area at a leading regional CPA firm

- CPA/MBT or CPA/JD/ LLM

- 7+ years of professional experience, with predominant/most recent experience at regional, national or Big 4 CPA firm

- Reviewed or performed compliance on at least 50 not-for-profit returns (Forms 990/990-PF)

- Reviewed or performed compliance on numerous unrelated business income tax returns (Forms 990-T)

- Experience consulting with not-for-profit management regarding exemption applications, various tax and management issues

- Experience defending clients in IRS audits

Contact: Please e-mail your résumé to Eileen Harris at eharris@windes.com.

An attractive compensation awaits the right candidate.

CPAs preferred; EAs and CTECs welcomed. Min 2 years Lacerte experience required. Contact: Please e-mail your résumé to Human Resources at info@progressivecpas.com.

Candidates must have a minimum of 2 years Lacerte experience and be EAs or CTECs. Contact: Please e-mail your résumé to Rosalie Morris at rosalie@awitax.com.

This is an in office position, remote work is not available. Contact: Please e-mail your résumé to Elaine McCoy at elaine@montgomerytaylorwealth.com.

- 4 – 7 years of public accounting tax experience (preferred)

- Strong technical skills in both accounting and tax preparation

- Prior experience working with CCH Software is preferred

- CPA license, Previous experience in a mid to large size CPA firm and a Masters of Taxation (preferred)

We offer an excellent compensation package, including a competitive base salary. Contact: Please e-mail your résumé to Margaret Castro at mcastro@spectrum-cpa.com.

- Assist with tracking tax return status’ and contacting clients to ensure all deadlines are timely met.

- Plan annual pre-tax season staff training event and collaborate with Tax Manager to update agenda and presentation materials

- Please check out our website: www.montgomerytaylorwealth.com to view the full job description!

Contact: Please e-mail your résumé to Elaine McCoy at elaine@montgomerytaylorwealth.com.

- Responsible for tax preparation of individuals and fiduciary tax returns.

- QuickBooks clean-up and preparation of business entities, depending on experience.

- Assist with preparation of Form 1099s for January deadline.

Check out our website to view the full job description: www.montgomerytaylorwealth.com Contact: Please e-mail your résumé to Elaine McCoy at elaine@montgomerytaylorwealth.com.

- Responsible for managing the tax reporting, tax planning, and compliance function.

- Manage employees, assign work and develop the tax department team.

- Must be familiar with regulations at the federal, state and local level.

- Represent clients with IRS, State or other audits.

- Review completed tax forms and provide recommendations to junior members of our team when needed.

Check out our website to view the full job description: www.montgomerytaylorwealth.com Contact: Please e-mail your résumé to Elaine McCoy at elaine@montgomerytaylorwealth.com.

- Responsible for tax interviews, preparation, review, and tax planning engagements.

- Assist with QuickBooks clean-up for business entities and sole proprietorships.

- Conduct tax research and communicate results internally and externally.

- Represent clients with IRS, State or local tax compliance issues.

Check out our website: www.montgomerytaylorwealth.com to view the full job description. Contact: Please e-mail your résumé to Elaine McCoy at elaine@montgomerytaylorwealth.com.

Responsibilities will include write up of multiple clients, preparation of compiled financial statements, and income tax returns. Requirements:

- Experience working in a CPA firm with multiple write-up clients

- A degree in accounting or has taken accounting classes with experience working for a CPA Firm

- Knowledge of QuickBooks and Lacerte

- Knowledge of Microsoft Office

- Strong Verbal & Written Communication skills

Benefits:

- Salary based upon experience

- 401(k) plan, including match and profit share

- Health Insurance

Contact: Please e-mail your résumé to Larry Sternshein at dayna@sternsheincpa.com.

Urgent!! Need tax preparer for established family business. CTEC and PTIN required. Familiar with individual and sole proprietor business tax returns.

- At least 3+ years as a tax preparer or EA.

- At least 1 year experience with Lacerte Is preferred.

- Willing to work long hours. Need tax preparer from present to April 15th.

- Job Types: Full-time, Temporary

- Salary: $20.00 to $30.00 /hour

- Pay may depend on skills and/or qualifications

Contact: Please e-mail your résumé to Julie Randel at julie@jstaxservices.com.

Our team members work hard, enjoy each other’s company, and do great work for our clients.

Compensation is between $25 – $35 per hour depending on your experience level. Contact: E-mail your résumé to Joe Kovar at joe@cpask.com .

This position could lead to a permanent full-time.

Compensation is between $25-$35, an hour, depending on the level of experience. Health and retirement benefits. Contact: E-mail your résumé to: career@cpadk.com.

We’re looking for experienced tax professional with experience starting and growing accounting practices to join our team and help us build a brand known for delighting their clients and empowering them with their finances.

Here is the link to the JOB DESCRIPTION: https://www.linkedin.com/jobs/view/head-of-tax-at-hyke-1477896092/ Interested? If you are interested, please send your résumé to Dhaval Bhatt at Dhaval@Hyke.me.

- Bachelor’s degree in Accounting or Finance preferred

- Active CA Certified Public Accountant license or Enrolled Agent license preferred

- 3+ years of tax preparation and review experience for individuals, businesses and trusts

- 2+ years of Quickbooks, Prosystems FX, Microsoft Word and Excel preferred

Contact: Please e-mail your résumé to Margaret DeLao at mdelao@brunoskorheim.com.

- 3+ years of tax preparation experience with complex individual tax returns

- Background preparing fiduciary, partnership and corporate returns as well as working knowledge of Lacerte tax system is a plus

- Experience in a public accounting firm performing compilation and review engagements is preferred

- Hours and days are somewhat flexible

Contact: Please e-mail your résumé to Sue Nepodal at sue.mckinneyt@gmail.com.

- Tax preparation data entry

- Provide client support via email and phone

- Office/clerical support

Required Qualifications:

- B.A.

- Strong attention to detail

- Ability to multi-task and work under time deadlines

- Excellent organizational skills with comfort to prioritize assignments

- Strong interpersonal communication skills

- Communicate effectively by email and phone with clients.

Compensation is commensurate with experience. www.morfinfinancial.com Contact: Please e-mail your résumé to Emily Morfin at tax@morfinfinancial.com.

- Prepare and review tax engagements and provide timely service to our clients

- Understanding of tax law and GAAP/GAAS

- Maintain client relationships and networking at professional associations

- General understanding of budgeting and production goals

- Participate in the growth and development of the staff accountants

Requirements:

- Bachelor’s degree in accounting

- 8+ years of tax preparation, research and planning in public accounting

- CPA license

Comprehensive Benefits Package:

- Medical, dental, vision, life, disability

- 401(k), pension and bonus

Contact: Please e-mail your résumé to Nataly Urquieta at nurquieta@jhs.com.

- Prepare income tax returns (individual, corp, partnership, fiduciary, etc.)

- Prepare and review extension calculations for businesses and individuals

- Review staff tax work and provide constructive feedback

- Assist with training and mentoring of tax interns

- Assist clients with accounting functions

- Prepare accurate workpapers

Preferred Education and Experience:

- Bachelor’s degree in accounting

- CPA license or CPA candidate

- 3+ years in public accounting

- Knowledge of research tools, tax code and regulations

- CCH ProSystem

- QuickBooks

Contact: Please e-mail your résumé to Nataly Urquieta at nurquieta@jhs.com.

- Temporary/seasonal full-time position through April/May. Possibility of continued part-time work.

- Qualified person must be flexible. Overtime required Jan-May.

- Good organizational skills/ability to multi-task

- Works well under pressure

- Team player & good customer service skills

- Prior tax season experience and knowledge of Lacerte preferred

- Input, scan & assemble client information into tax program

- Knowledge of Quickbooks desktop and online

- Need to know debits and credits

- Willing to answer telephone and take messages

- Assist CPAs with tax & accounting projects

Contact: Please e-mail your résumé to Maria Thomas at mariatcpa@aol.com.

- Tax Preparation and Review of Tax Returns (many individuals, some corps, partnerships and trusts).

- Must have 5+ years of high volume LACERTE TAX PROGRAM experience.

- Flexible hours and days are available.

- Need someone who KNOWS how to prepare tax returns using LACERTE.

- $40 – $60 per hour DOE.

- This is a seasonal position.

Job Type: Full-time, seasonal Salary: $40.00 to $60.00 /hour Contact: Please e-mail your résumé to Tina Weisman at apply@michaelhinescpa.com.

We are a growing CPA firm with multiple offices providing tax, accounting and consulting services. We are looking for an individual that is self-motivated, energetic and a quick learner. We will train you and give you plenty of support. We promote a work environment where we like to come to work each day because we enjoy interacting with one another and we are constantly presented with new challenges. Please visit our website for more details: mrbkcpa.com

- Prepare and review federal and state tax returns for partnerships, C corporations, S corporations, individuals, non-profits, and trusts

- Prepare and review tax planning and forecasting calculations for businesses and individuals

- Prepare and review extension calculations for businesses and individuals

- Assist with training and mentoring of staff accountants and interns

Qualifications:

- Bachelor’s Degree required

- 4-6 years of experience in public accounting

- CPA or CPA candidate is preferred

See our full post below https://dpvb.bamboohr.com/jobs/view.php?id=12 Contact: Please e-mail your résumé to Joel Bock at Joel@dpvb.com.

- Bachelor’s degree in Accounting, Masters in Taxation preferred

- CPA license (or eligible for exam for Senior position)

- Proficient in individual, partnership, and trust taxation

- Experience supervising staff

Competitive Compensation Package:

- Paid Holidays

- Paid Time Off (PTO)

- Generous benefits which include Medical, Dental, Vision, Life Insurance

- 401(k)

- Profit Sharing

Contact: Please e-mail your résumé to Tom Zonaras at careers@jgdnet.com.

Seeking a full time experienced Senior Tax Preparer with a minimum of 6-7 years experience in tax, individuals, corporations, partnerships and estates & trusts. Experience with UltraTax and Quickbooks Online a plus.

Excellent communication and client contact skills a must. Contact: Please fax your resume to (650) 225-0129 or send via e-mail to hr@tiret.com for immediate consideration. No phone calls please.

- See: ZZRJLLP.com

- Work with musicians, pro athletes. Ideal candidate has experience & ability to provide elevated service, self-motivated, able to work independently & in team environment.

- Tax prep/planning, write up, business mgmt (touring bands).

- Licensed CPA; 5-10 years recent experience; BS, MS pref; excellent accounting, Excel, communication skills; attention to detail, handle multiple clients & deadlines; Prosystem

- Competitive comp; 401k; PTO, paid health, flex schedule, other perks

- Please provide a cover letter, resume and salary requirements

Contact: Jeff Johnson — Resume@zzrjllp.com

- Sales experience

- Outgoing personality with proven communication skills

- Good written communication skills

- Ability to work in a team

- Detail oriented, well organized, and analytical

- Time-management skills

- BA degree desired (or equivalent experience)

- Good computer skills (Microsoft Office, database management systems, etc.)

- Ability to multitask

- Available to travel within California and Nevada, with heavy travel in the months of November, December, and January

Preferred: Candidates who have experience with face-to-face and telephone sales and who possess proven follow-through skills. Contact: Lisa Mackey — lisa@spidell.com

A small accounting office in Encino 91316 is looking for a licensed tax preparer (CPA/EA or on track to get a license) permanent part-time, may become full time. It’s not an entry level position. Duties include posting adjusting journal entries, individual and business income tax return preparation.

We use UltraTax and QuickBooks.

Flexible hours. Contact: Please email your résumé to: elena@matsvaycpa.com.

We are seeking a seasoned tax accountant for our 15-person accounting firm. We provide high level tax preparation and planning services to private companies and individuals. Preferred Skills:

- 5+ years of tax experience

- Knowledge of Lacerte and Microsoft Office

- Real estate and multistate tax experience is a plus

We offer:

- Flexible Hours and work/life balance

- 401k plan with 5% company contribution

- A fun, professional work environment steps from the beach

Contact: Please submit your résumé and cover letter to taxprofessional@meeposcpa.com.

Hours and schedule can be flexible.

This position could lead to permanent full-time. Contact: Email your résumé to: info@porteryeecpas.com

Candidate should be an EA or CTEC with 3 years recent experience and familiar with Lacerte software. Contact: Please submit your résumé to Admin@Bermfin.com.

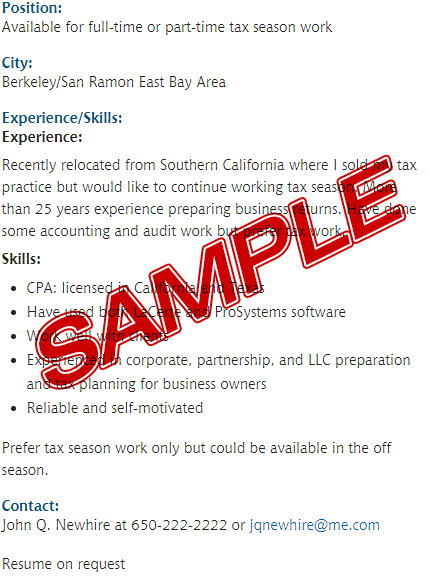

Job Wanted

Looking for individuals with talent, tenacity, and commitment? Check here for candidates currently seeking employment Job seekers, click here to submit your qualifications

As an Enrolled Agent worked extensively to help clients with audits and notices from IRS and state tax authority.

Available to work on weekends and evening hours temporarily. Contact: Bijayini Sinha at bijayini.enrolledagent@gmail.com Please include “Spidell’s Job Board” in the subject line.

- 5 years of tax experience

- Working experience with Lacerte, Word, Excel

Contact: Jaime Mechulan Castiel at castielcpa@gmail.com. Please include “Spidell’s Job Board” in the subject line.

Permanent, Temporary, Tax Season Only, or Specific Return Consulting City: Long Beach/Signal Hill area Experience/Skills:

- Over 40 years experience in all aspects of the tax preparation industry

- CTEC & IRS (AFSP) registered.

- 14 years in development and support for professional tax software products.

- Specialties include tax research and trouble shooting tax programs

- Skilled at client interviews and return reviews.

- Experienced preparer of both Individual and Business returns, including Estates, Gifts, and Trusts

- Current/recent software experience: UltraTax, Tax Act Professional, Lacerte, Drake

- Previous software experience: Compucraft, Exactax, TaxWorks

Contact: Robin L. Rehmet at r24eldo@gmail.com. Please include “Spidell’s Job Board” in the subject line.